FINANCING & COMMERCIAL LOANS

Smart Funding Solutions for Commercial Real Estate

Securing financing for commercial real estate is becoming more challenging as banks tighten lending criteria. Higher down payment requirements, stricter income verification, and rising interest rates are making traditional financing less accessible. But the right strategy can help you secure the funding you need.

Alternative Financing Solutions

If traditional bank loans don’t work for your situation, consider these financing options:

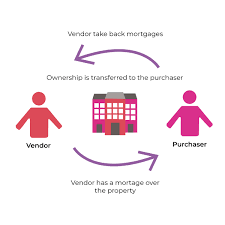

Vendor Take-Back (VTB) Mortgages

A Vendor Take-Back Mortgage allows the seller to finance part of the property purchase, reducing the amount you need from a bank. This strategy helps when:

✔️ You need a lower down payment than traditional lenders require.

✔️ You’re unable to secure full financing from a bank.

✔️ The seller is open to earning interest on the loan while keeping equity in the property.

This option creates a win-win scenario, allowing buyers to close deals while sellers benefit from interest income.

Credit Unions vs. Banks

💰 Credit Unions – Lower interest rates, reduced fees, and a community-focused approach.

🏦 Banks – A wider range of loan products but stricter lending requirements.

If you qualify for a credit union loan, it could mean significant cost savings over the life of your mortgage.

B Lender Mortgages

For buyers who don’t meet bank requirements, B Lenders provide more flexible options, including:

✔️ Interest-only mortgages – Lower initial payments to improve cash flow.

✔️ Customized financing solutions – Ideal for investors and businesses with unique financial situations.

✔️ Less stringent approval criteria – Suitable for those with non-traditional income sources.

Things to consider: B Lender mortgages may come with higher insurance costs and repayment restrictions, but they can be a great alternative when traditional financing isn’t available.

All-Inclusive Mortgages (AIM)

For buyers looking to consolidate multiple financing sources, an All-Inclusive Mortgage (AIM) can simplify the borrowing process, combining different loans into a single, streamlined payment.

Find the Right Financing for Your Next Investment

Whether you’re buying your first commercial property or expanding your portfolio, securing the right financing is key to success. Let’s explore your options—contact me today!

Commercial Real Estate Insights

Your guide to smarter financing, expert tips, and valuable opportunities in commercial real estate.